Can Batteries Pivot from EVs to Grid Support?

February 21, 2026 § Leave a comment

The February 12 print edition of the NY Times had a piece under the Climate Forward banner on A2. It observes that policy actions have led to a decrease in demand for electric vehicles (EVs), and that at least two auto manufacturers are pivoting to repurposing battery manufacturing to supply the market for storage in support of two areas with relatively robust demand. These are electricity grids with intermittency in renewable power and data centers.

First, the premise. Certainly, policy measures by the government, especially the repeal of the tax credit, have reduced the consumer demand for EVs in the US. Equally, grids continue to add renewable capacity, in part due to demand and in part due to solar electricity today being the lowest-cost form of energy. However, due to low capacity factors, and temporal fluctuations, this source requires storage as backup. The most ubiquitous storage means are batteries.

The newest entrants into the power demand sweepstakes are data centers, as noted in the NYT piece. The owners of these power hogs prefer electricity that is substantially carbon free. Microsoft went so far as to enable de-mothballing of the Three Mile Island conventional nuclear plant and guaranteeing offtake at a heavy premium to prevailing prices in the region. Expect also more “behind the meter” capability, meaning not acquired from the grid. This business model is a net benefit to consumers in the region because the cost will not be passed on to them.

The pivot to repurpose EV batteries to grid support applications is informed by the fact that EV batteries have two distinct cathode chemistries, and one is more suited to the stationary application. For the same storage capacity, the Nickel Manganese Cobalt (NMC) variant is lighter, but more costly than the Lithium Iron Phosphate (LFP). In the EV application the lightness often trumps the cost element primarily because longer range can be achieved with manageable addition to weight. Longer range and fast charging have emerged as dominating features sought by customers, especially in the higher end sedan and SUV lines. This has resulted in the vast majority of passenger EVs being powered by NMC batteries. In fact, to my knowledge, the only passenger EV using LFP batteries is the Tesla Model 3 with rear-wheel drive. This is a vehicle that targets the lower cost and limited range market segment. Pickup trucks are more suited to LFPs because they can generally tolerate the extra weight. The standard range Ford 150 Lightning uses LFPs and the extended range one uses NMCs.

To recap, defining characteristics of batteries in EV applications are high energy density and light weight, allowing for greater range before requiring recharging. By contrast, grid support batteries are not too bothered by these characteristics, because space is not at a premium, and the extra weight is tolerated in exchange for lower prices. But they prioritize the feature of longer life, defined by surviving more numerous charge/discharge cycles. This is because grid support requires batteries to be recharged much more frequently than in the motive application.

LFP batteries were invented by Prof. Goodenough at the University of Texas, Austin. He shared the Nobel Prize with two others in 2019 for lithium-based batteries as a class. While invented in the mid-1990s, LFPs were initially shunned by EV manufacturers. The defining characteristic of an LFP is the longer life. These batteries last for over 4 times as many charge/discharge cycles as NMC equivalents. All rechargeable battery lives benefit from not fully charging or discharging, and NMC batteries, including the ones in cell phones, last longer if charged just to the 80% level. LFP batteries are something of an exception in that a full charge to 100% has minimal impact on life. Another in the plus column for LFPs. A further plus is that LFP batteries are also believed to be safer.

The use of iron in place of more scarce imported cobalt, manganese and nickel is preferable from a resilience standpoint. Compared to the other metals, the price of iron is greatly lower and more stable. Cobalt has been particularly volatile, ranging from USD 22,000 to 94,000 per metric ton over the last eight years. Importantly, much of the volatility on the upside has been attributed to EV demand.

Now to the pivot. All EV batteries could, in principle, be used in the grid support market. But as noted above, LFPs are more suited, and their preferential use will likely stabilize the price of cobalt, thus benefiting the NMC market. Further, manufacturers of the LFP variant will have cost and desirability advantages in serving the grid market and, to a degree, in competing with Chinese imports. A NYTimes story on February 16 notes that the F15 Lightning battery plant in Tennessee is being shut down but may re-start to serve storage. They can manufacture both types but would be well served to make just LFPs. Absent tariffs, NMC batteries will have a tough time competing with imported LFPs.

In conclusion, the pivot makes more sense for the LFP* than for the NMC EV battery variant.

* The slow one now, will later be fast, from The Times They are a Changin’ (1964), written and performed by Bob Dylan

Vikram Rao

February 21, 2026

LNG’s Tax Break Controversy

August 5, 2025 § Leave a comment

A story is breaking that Cheniere Energy is applying retroactively for an alternative fuel tax credit for using “boil off” natural gas for propulsion of their liquefied natural gas (LNG) tankers in the period 2018 to 2024, the year that tax break expired. The story leans towards discrediting the merits of the application. Before we get into that, first some basics.

LNG is natural gas in the liquid state. In this state it occupies a volume 600 times smaller than does free gas, thus making it more amenable to ocean transport. It achieves this state by being cooled down to – 162 degrees C. Importantly, it is kept cool not by conventional refrigeration, but by using the latent heat of evaporation of small quantities of the liquid. If the resultant gas is released to the atmosphere, it is a greenhouse gas 80 times more potent than CO2 over 20 years. In recent years, tanker engines have been repurposed to burn natural gas. The “boil off” gas, as it is referred to, is captured, stored and used for motive power. As with most involuntary methane release situations, capture has the dual value of economic use and environmental benefit. In the case of LNG tanker vessels, the burn-off can handle most of both legs of the voyage. Short haul LNG trucks also have boil off gas, and it is unlikely that the expense of recovery and dual fuel engines is incurred.

Also, by way of background, Cheniere Energy is a pioneer in LNG. It began with their construction of import terminals in the 2008 timeframe. Shortly after that US shale gas hit its stride and LNG imports evaporated. This was followed by US shale gas becoming a viable source of LNG export, and Cheniere again took the lead in pivoting to convert import terminals to export capability. Today they are the leading US exporters.

Now to the merits of considering boil off natural gas as an alternative fuel. The original intent of the law, which expired in 2024, appears to have been to encourage substitution of fuel such as diesel with a cleaner burning alternative. However, the letter of the law limits this to surface vehicles and motorboats. LNG vessels are powered by steam (using a fossil fuel or natural gas), and more lately by dual fuel engines using boil off gas and a liquid fuel ranging from fuel oil to diesel. Using a higher proportion of boil off gas certainly is environmentally favorable, mostly because sulfur compounds will essentially not be present and particulate matter will be vastly lower than with diesel or fuel oil. If this gas was not used for power, hypothetically, it would be flared, leading to CO2 emissions and possibly some unburnt hydrocarbons. Capture and reuse provide an economic benefit, so should it qualify as an alternative fuel?

An analog in oil and gas operations could be instructive. Shale oil can be expected to have associated natural gas because light oil tends to do that because of the mechanism of formation of these molecules. Heavy oil, for example, could be expected to have virtually no associated gas. When oil wells are in relatively small pockets and/or in remote locations and because of the relatively small volumes or remoteness, export pipelines are not economic. This gas is flared on location. Worldwide 150 billion cubic meters was flared in 2024, an all-time high. Companies such as M2X Energy capture this and convert it to useful fuel such as methanol, and in the case of M2X the process equipment is mobile. The methanol thus produced could be considered green because emissions of CO2 and unburnt alkanes would be eliminated.

Were that to be the case, the use of boil off gas has some legs in consideration of it being an alternative fuel. However, the key difference in the analogy is that in the case of the LNG vessel, an economic ready use exists. Not so in the remotely located flared gas. But is an economic ready use a bar for consideration? Take the example of CNG or LNG replacing diesel in trucks. They likely quality for the credit. The tax break approval may well come down to a hair split on the definition of motorboat. An LNG vessel is certainly a boat, and has a motor, but does not neatly classify as a motorboat in the parlance*. But if the sense of the law is met, ought the letter of the law prevail?

Vikram Rao

*That which we call a rose, by any other name would smell as sweet, Juliet in Romeo and Juliet, Act II, Scene II (1597), written by W. Shakespeare.

Are Cows Getting a Free Pass on Methane Emissions?

January 20, 2025 § Leave a comment

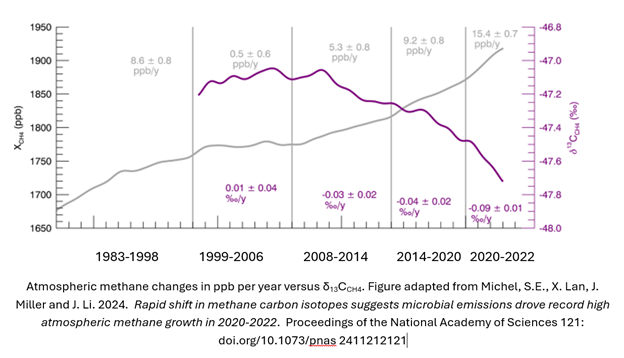

A recent study reported in the Proceedings of the National Academy of Sciences1 convincingly shows that atmospheric methane increases in the last 15 years can be attributed primarily to microbial sources. These comprise ruminants (cows in the main), landfills and wetlands. Yet, policy action on methane curbing has largely been focused on leakage in the natural gas infrastructure. In the US as well as in Canada, policies have fallen short of comprehensive action in the agricultural sector2,3.

Before we discuss the study, first some (hopefully not too nerdy) basics. Methane has the chemical formula CH4. The common variety designated 12CH4, has 6 protons and 6 neutrons in the nucleus. An isotope, 13CH4, has an additional neutron. The 13CH4 to 12CH4 ratio is used to detect the origin of the CH4. The actual ratio is compared to that of a marine carbonate, an established standard. The comparison is expressed as δ13CCH4 with units ‰ and is always a negative number because all known species have a lower figure than that of the standard carbonate. Microbially sourced methane will have ratios of approximately -90 ‰ to -55 ‰ and methane from natural gas will be in the range -55 ‰ to -35 ‰. This is the measure used to deduce the source of methane in the atmosphere.

Here is the lightly adapted main figure from the cited study. The data are primarily from The National Oceanic and Atmospheric Administration’s Global Monitoring Laboratory, but as shown in the paper, similar results have been observed from other international sources. The gray line is the atmospheric methane, shown as increasing steadily over decades, but with steeper slopes in the near years. The steeper portion is roughly consistent with the period in which the isotopic ratio becomes increasingly negative. This implies more negative contribution, which in turn means that the main contributory species is microbial. Note also the increased severity of the trend in 2020-2022, and coincidentally or not, increased methane in atmosphere slope in those years. The paper authors do not see the correlation as coincidental. They emphatically state: our model still suggests the post-2020 CH4 growth is almost entirely driven by increased microbial emissions.

A quick segue into why methane matters. The global warming potential of methane is 84 times that of CO2 when measured over 20 years, and 28 times when measured over 100 years. Climatologists generally prefer to use the 100-year figure (and I used to as well), but urgency of action dictates that the 20-year figure be used. The reason for the difference is that methane breaks down gradually to CO2 and water, so it is more potent in the early years.

These research findings point to the need for policy to urgently address microbial methane production. This does not mean that we let up on preventing natural gas leakage, the means to do which are well understood. The costs are also well known and, in many cases, simply better practice achieves the result. In fact, the current shift to microbial methane being a relatively larger component could well be in response to actions being taken today to limit the other source. But it does mean that federal actions must target microbial sources more overtly than in the past. We will touch on a few of the areas and what may be done.

Landfill gas can be captured and treated. In the US, natural gas prices may be too low to profitably clean landfill methane sufficiently to be put on a pipeline. Part of the problem is that, due to impurities such as CO2, landfill methane has relatively low calorific value, almost always well short of the 1 million BTU per thousand cubic feet standard for pipelines. However, technologies such as that of M2X can “reform” this gas to synthesis gas, and thence to methanol, and a small amount of CO2 is even tolerated (Disclosure: I advise M2X).

Methane from ruminants (animals with four-compartment stomachs tailored to digest grassy materials) is a more difficult problem. Capture would be operationally difficult. The approach being followed by some is to add an ingredient to the feed to minimize methane production. Hoofprint Biome, a spinout from North Carolina State University, introduces a yeast probiotic to carry enzymes into the rumen to modify the microbial breakdown of the cellulose with minimal methane production. I would expect this more efficient animal to be healthier and more productive (milk or meat). Nailing down of these economic benefits could be key to scaling, especially for dairies, which are challenged to be profitable. Net-zero dairies could be in our future.

Early-stage technologies already exist to capture methane from the excrement from farm animals such as pigs. These too could take approaches similar to those proposed for landfill gas, although the chemistry would be somewhat different. Several startups are targeting hydrogen production from pyrolysis of methane to hydrogen and carbon. The latter has potentially significant value as carbon black, for various applications such as filler in tires, and biochar as an agricultural supplement. If the methane is from a source such as this, the hydrogen would be considered green in some jurisdictions.

The federal government ought to make it a priority to accelerate scaling of technologies that prevent release of microbial methane into the atmosphere. With early assists, many approaches ought to be profitable. Then it would be a bipartisan play*.

Vikram Rao

*Come together, right now, from Come Together, by The Beatles, 1969, written by Lennon-McCartney

1 Michel, S.E., X. Lan, J. Miller and J. Li. 2024. Rapid shift in methane carbon isotopes suggests microbial emissions drove record high atmospheric methane growth in 2020-2022. Proceedings of the National Academy of Sciences 121: doi.org/10.1073/pnas 2411212121

2 Patricia Fisher https://fordschool.umich.edu/sites/default/files/2022-04/NACP_Fisher_final.pdf

3 Ben Lilliston 2022 https://www.iatp.org/meeting-methane-pledge-us-can-do-more-agriculture

The Bulls Are Running in Natural Gas

January 2, 2025 § Leave a comment

Ukraine shut down the natural gas pipeline from Russia to southern Europe yesterday. While not unexpected, yet another red rag for natural gas bulls. And ascendency for liquefied natural gas (LNG) futures and associated increase in US influence on Europe because, according to the Energy Information Administration, most of new LNG supply in the world will be from the US. Of course, that means more fodder for the debate in the US on whether LNG exports will increase domestic prices more than mere price elasticity with demand. I see greater demand impact from a different source, but more on that below.

Natural gas usage will not be in decline anytime soon. In fact, usage will steadily increase for the next couple of decades. Much of the incremental usage will be for electricity production, with a business model twist: expect a trend to captive production “behind the meter”. Not having to deal with utilities will speed introduction. Of course, the entire production will have guaranteed offtake, but that will not be much of a hurdle for some of the deep pocketed applications owners.

So, what has changed? Why are fossil fuels not in decline in preference to carbon-free alternatives? Much of the answer is that all fossil fuels are not created equal. Ironically, oil and gas are created by precisely the same mechanism, but their usage and the associated emissions are horses of different colors. At some risk of oversimplification, oil is mostly about transportation and natural gas is mostly about electricity and space heating.

At a first cut, oil usage will reduce when carbon-free transport fuel alternatives take a hold. Think electric vehicles, methanol powered boats, biofuels for aviation and so forth. Similarly, natural gas usage reduction relies upon rate of growth of carbon-free electricity (note my use of carbon-free instead of renewable), which today is almost all solar and wind based. Advanced geothermal is nascent and nuclear is static except for some rumblings among small modular reactors (SMRs).

In the case of oil in transportation, when the switch to battery or hydrogen power arrives, oil will be fully displaced from that vehicle. Not counting hybrids in this discussion, nor lubricating oils. In electricity, however, solar and wind power being intermittent, some other means are needed to fill the gaps. Those means are dominantly natural gas powered today for longer duration (greater than 10 hours). For short durations, and diurnal variations, batteries get the job done for around 2 US cents per kWh. Very affordable, and unlikely to change. To underline the point, solar and wind need natural gas for continues supply. Until alternatives such as long duration storage, geothermal or SMRs make their presence felt, every installation of solar or wind increases natural gas usage.

As if that were not bad enough, a recent complication is increasing electricity demand. Artificial Intelligence, or AI, and to a greater extent the Generative AI variant, has increased electricity demand dramatically. For example, a search query uses 10 times the energy when employing Gen AI, compared to a similar conventional search. The information is presumably more useful, but the mere fact is that these searches and other applications such as in language, are power hogs. The data center folks are trolling for power in geothermal and nuclear. Microsoft went so far as to commission the de-mothballing of the 3 Mile Island conventional nuclear facility. Control room picture shows its age. The operators will face what an F18 pilot would, if asked to fly an F14 (apologies, just saw Top Gun Maverick film).

Almost all the big cloud folks want to use carbon-free power, 24/7/365. Good luck getting that from a utility. Some, such as Google with Fervo Energy geothermal, are enabling supply to the grid and capturing the credit. Others are going “behind the meter”, meaning captive supply not intended for the grid. The menu is geothermal, SMRs and innovative storage systems. All have extended times to get to scale. Is there an option that is more scalable sooner to suit the growth pattern of AI?

Natural gas. A combined cycle plant (electricity both from a gas turbine and from a later in cycle steam turbine) could be constructed in less than 18 months. Carbon capture is feasible, even though the lower CO2 concentrations of 3 to 5% (as compared to 12 to 15% for coal plants) makes it costlier (a reason I am bearish on direct air capture, with 0.04% concentration). At the current state of technology, I estimate that will add 3 to 4 cents per kWh. This technology will keep improving, but that number is already worth the price of admission, at least in the US, where the base natural gas price is low. Not renewable, but nor is nuclear. You see why I prefer the carbon-free language?

To be behind the meter, the plant would need to be proximal to the data center. Data centers prefer cool weather siting for ambient heat discharge. Reduces power usage. Since natural gas pipelines serve a wide area, this ought not to be a major constraint. However, it could favor producers in the northern latitudes, especially if a rich deposit is currently unconnected to a major pipeline. Favorable deals could be struck especially with long term offtake contracts in part because the gas operator will eliminate the markup by the midstream operator. These conditions could be met in Wyoming, Alberta (Canada) and, of course, Alaska.

We used to refer to natural gas as a bridge to renewables, until that phraseology fell out of vogue. The thinking was that gas could replace coal to provide some CO2 emissions relief (and it did that for the US), and eventually be replaced by renewable energy. The model suggested above does not fit that definition. Those plants will likely not be replaced because they would be essentially carbon neutral. And they would enable a powerful new technology the foundations of which already have been awarded the 2024 Nobel Prize in Physics. Gen AI may well lose some of its luster, but the machine learning underpinnings will survive and continue to deliver. All that will need data crunching. More data centers are firmly in our future.

Those that are still inclined to teeth gnashing on emissions from natural gas production ought to ponder nuclear spent fuel disposal, mining for silica for solar panels and the problem with disposal of disused wind sails, to name just a few. Every form of energy has warts*. We simply need to minimize them.

Vikram Rao

January 2, 2025

*Every rose has its thorn, from Every Rose Has Its Thorn, 1988, performed by Poison, written by Brett Michaels et al.

Drill Baby Drill, Drill Hot Rocks

December 5, 2024 § Leave a comment

“Drill baby drill” is being bandied around, especially post-election, reflecting the views of the president-elect. Thing is, though, baby’s already been drilling up a storm. World oil consumption was at an all-time high in 2023, breaking the 100 million barrel per day (MMbpd) barrier. And the International Energy Association (IEA) projects further demand growth, to about 106 MM bpd by 2028. The IEA also projects the US as the largest contributor to the supply, provided the sanctions on Russia and Iran continue.

Courtesy the International Energy Association

To execute the stated intent to stimulate US production, all that the new White House needs to do is not mess with the sanctions. For ideological reasons they may be tempted to open the Alaskan National Wildlife Refuge to leases. But none of the majors will come, and not even the larger independents. Easier pickings in shale oil and in wondrous new opportunities such as in Guyana. Is it still a party if nobody comes?

Note in the figure above that the projection by the IEA has roughly the same slope as the pre-pandemic period, with a bit of a dip in the out years ascribed to electric vehicles. And if that were not enough, world coal consumption hit a historic annual high of 8.7 billion tonnes in 2023, despite Britain, which invented the use of coal, closing its last mine this year. The largest increases were in Indonesia, India and China, in that order. Let me underline, both oil and coal hit all-time highs in usage last year. So much for the great energy transition.

So, what gives? China and India, two with the greatest uptick in coal usage, need energy for economic uplift, and for now that means coal for them, since they are net importers of oil and gas. Consider though that the same countries are numbers 1 and 3 in rate of adoption of solar energy. What this means is that solar and wind cannot scale fast enough to keep up with the demand. Making matters worse is the ever-increasing demand created by data centers.

One reason for not keeping up with demand is land mass required. Numbers vary by conditions, especially for wind, but solar energy needs about 5 acres per MW, while wind on flat land typically needs about 30 acres per MW. Compare that to a coal generating plant, which is 0.7 acres per MW (without carbon capture). Wind also tends to be far from populated areas, so transmission lines are needed, and much wind energy is curtailed due to those not being readily constructed. To add to the complication, both solar and wind plants have low capacity factors, under 40%. So, nameplate capacity is not achieved continuously, and augmentation is needed with batteries or other storage means. Finally, governments would like the communities with retired coal plants to benefit from the replacements. This is hard at many levels, not the least being availability of land mass, and because the land area required is many times that which was occupied by the coal plant being replaced. All this holds back scale.

Geothermal Energy. Two types of firm (high capacity factors) carbon-free energy that fit the bill in terms of land mass, are geothermal energy and small modular reactors. Here we will discuss just the former, which involves drilling wells into hot rock, pumping water in and recovering the hot fluid to drive turbines. Fervo Energy, in my opinion the leading enhanced geothermal (EGS) company (disclosure: I advise Fervo, and anything disclosed here is public information or my conjecture), has been approved for a 2 GW plant in Utah, which has a surface footprint of 633 acres. This calculates to about 0.3 acres per MW. The footprint of Sage Geosystems is also similar. Sage also has an innovative variant which takes advantage of the poroelasticity in rock, and which could provide load following backup storage for intermittency in solar and wind, thus enabling scale in a different way.

Aside from the favorable footprint of Fervo emplacements (incidentally, the underground footprint is significant because each of the over 300 wells is about a mile long), the technology is highly scalable for the following reasons. All unit operations are performed by oilfield personnel with no additional training, and therefore, readily available. Certainly, the technology is underpinned by unique modeling (developed in large part in the Stanford PhD thesis of a founder), but the key is that when oil and gas production eventually diminishes, the same personnel can be used here. In fact, an oil and gas company could have geothermal assets in addition to their oil and gas ones, and simply mix and match personnel as dictated by demand.

The shale oil and gas industry found that when multiple wells were operated on “pads”, cost per well came down significantly. Those learnings would apply directly to EGS. Accordingly, I would expect EGS systems at scale to deliver carbon free power, 24/7/365, at very favorable costs.

Governments and investors ought to take note that EGS variants are possibly the fastest means for economically displacing coal, and eventually oil. In the case of the latter, even that displacement does not eliminate jobs.

As the title revealed, the refrain now changes a bit to: Drill baby drill, drill hot rocks*.

Vikram Rao

* Lookin’ for some hot stuff, baby, in Hot Stuff by Donna Summer, 1979, Casablanca Records

Energy Engineering in the Triangle

September 30, 2010 § Leave a comment

The national imperatives of energy security and sustainable energy development will drive the creation of new businesses centered around alternative energies. We expect these to fall into t wo areas: replacement of oil for transportation and less carbon intensive electricity production. In addition, research regarding intelligent electricity grid has become an interesting combination of these two areas.

The national imperatives of energy security and sustainable energy development will drive the creation of new businesses centered around alternative energies. We expect these to fall into t wo areas: replacement of oil for transportation and less carbon intensive electricity production. In addition, research regarding intelligent electricity grid has become an interesting combination of these two areas.

Furthermore, the more efficient use of energy will also play a central role in sustainability. The engineering work force required to execute all of these would benefit from college training that recognizes these specific fields of study. An Energy Engineering (En E) curriculum could well be the solution. Here’s what such a discipline might entail.

The foremost disciplines in the general field of energy engineering are those of Nuclear Engineering and Petroleum Engineering (Pet E). We will use the latter for discussion because it is more widespread and serves a mature industry fairly well with a defined set of required training (Nuclear is similar). Thus it is able to sustain a specialist discipline.

This will not be the case for the En E program serving the alternative energy industry. The industries served could have elements of the following: solar electricity, wind electricity, biofuels with biochemical and thermochemical variants, smart grid and related enablers, energy efficient devices, batteries and other storage, clean coal, carbon sequestration, electric cars and related endeavors such as fuel cells, and hydro. This breadth alone hinders a unique En E four year program.

Even Pet E is subject to the whims of the industrial cycle. In a recent trade publication, an influential department chair recently put out a plea for hiring their graduates. One of the problems is that the hottest play in petroleum today is shale gas. They are hiring, but the volume required is in the hard core disciplines of Mechanical, Electrical and Chemical Engineering, not Pet E. In fact, far more of these comprise the petroleum work force in general. Alternative energy programs should use this knowledge as a guide.

A minor not a free standing major

The solution is to offer concentrations in En E, perhaps even minors. These would be enhancements to core engineering degrees. There would be an analog for the sciences, wherein a Chemistry degree could be supplemented with an Energy Science concentration.

Such concentrations would be expected to comprise four to five courses of nominally three units each. Courses would be selected from a menu, with the selections directing the student to particular industries. But the key to this approach is that a down cycle in that industry is not a catastrophe. The student can rely on the core engineering skill set for an entry level job.

Social Science is a key ingredient

An important element of this minor would be the treatment of the social science component. Engineering curricula typically requires few social science courses. But an En E concentration (minor) will enable students to learn more about the social science approach to sustainable energy.

In order to incorporate this concept into the minor, students would be required to choose courses from a set list that include the themes of energy and the environment. The intent would be to learn the principles of economics, psychology and the like, but linked to an energy setting. This could necessitate modified courses in those departments. Energy is a field of considerable interest to students today, as evidenced by surveys in the local institutions. So, such modifications would likely be welcome at a broad level.

The 3 U offering

When the offerings are compiled there will undoubtedly be gaps in faculty resources. NC State already has a concentration in power engineering, but even they will face gaps in other areas. The Triangle area offers the unique opportunity for a program that allows for collaboration between all three universities. We are referring to this as the 3 U solution.

Bi-lateral programs already exist, including the Robertson program (UNC and Duke) and the Biomedical Engineering curriculum (NC State and UNC). While faculty additions will be needed, the resource pooling will allow the program to get on track more quickly. RTI can also be expected to be a player, most likely in the biofuels space. The possibility exists for the participation of some of the RTP powerhouses playing in the energy space.

In short, the Triangle area is unique in that three important research universities participating in the energy space are in close proximity. Add to that the presence of RTI, an unquestioned leader in energy research, with a recent Department of Energy $169 million award directed to carbon sequestration. This powerful combination allows for a jump start to Energy Engineering. No other area in the world has this capability.